Will China Dominate the Robotics Market?

A strategic manufacturing play years in the making with massive implications for all businesses

The story of China's rise in robotics isn't merely about technological advancement—it's about deliberate industrial policy executed with remarkable precision over the past decade. While Western commentary often focuses on China's cheap labor advantages, something more profound is happening: China is systematically building the manufacturing infrastructure for the next industrial revolution, one robot at a time.

The Trillion Yuan Bet

In March 2025, China's National Development and Reform Commission announced a massive 1 trillion yuan ($138 billion USD) state-backed venture capital fund focused on robotics, AI, and cutting-edge innovation. This isn't a short-term stimulus package but rather a methodical, two-decade investment plan designed to cement China's position in advanced manufacturing.

For context, this investment dwarfs most Western nations' entire industrial policy budgets. It represents China's understanding that robotics isn't just another sector—it's the backbone of future manufacturing competitiveness.

The Manufacturing Imperative

China's robotics strategy follows a familiar playbook we've seen with solar panels, batteries, and electric vehicles: build domestic capacity, achieve economies of scale that competitors can't match, drive down costs through volume, and then export globally at unbeatable prices.

The numbers tell a compelling story. In just ten years, China's share of global industrial robot installations has exploded from roughly one-fifth to more than half of worldwide demand. Robot density—robots per 10,000 manufacturing workers—has skyrocketed from outside the top 10 in 2018 to third place globally in 2024 with 470 robots per 10,000 employees. This surge wasn't accidental but the direct result of the "Made in China 2025" plan initiated by Li Keqiang in 2015.

The Vertical Integration Advantage

What makes China's approach uniquely powerful is its emphasis on vertical integration. Companies like Estun manufacture up to 95% of core components in-house, enabling rapid iteration and cost control that Western competitors struggle to match.

The infamous "Xiaomi lights-out factory" provides a glimpse of what's possible: a fully automated facility producing one smartphone per second with zero human employees. This isn't about replacing cheap labor; it's about creating manufacturing organisms that operate with unprecedented efficiency and scale.

The Humanoid Frontier

Perhaps most striking is China's early lead in humanoid robotics—the form factor that could revolutionize both manufacturing and service industries. At the 2024 World Robot Conference in Beijing, Chinese companies showcased 27 different functioning humanoid robots, while Tesla's much-hyped Optimus remained a static display.

Chinese EV manufacturers are pivoting aggressively into this space, leveraging their existing expertise in battery technology, environmental sensing, and supply chain management. The Unitree H1, which can perform synchronized choreography with both robots and humans, sells for $90,000—less than half the cost of comparable Western models.

The Component Supply Chain Moat

Morgan Stanley estimates that China now controls 63% of key companies in the global supply chain for humanoid robot components. This dominance is particularly pronounced in actuators and rare earth processing—the critical elements that allow robots to move with precision and power.

The manufacturing cost differential is stark: building a robot arm (equivalent to the Universal Robots UR5e) costs approximately 2.2 times more in the US than in China. Even components labeled "Made in USA" often rely heavily on Chinese-made parts and materials, with no viable scalable alternatives.

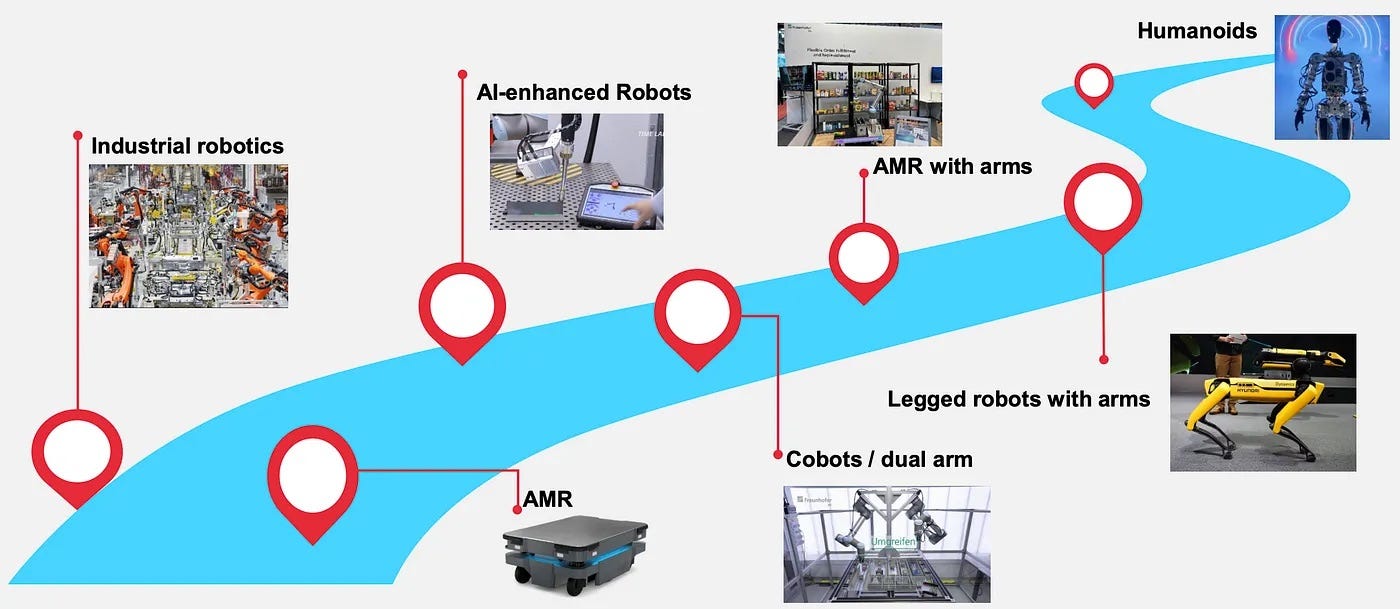

General Purpose Robotics Are Next

The holy grail of robotics isn't specialized machines but general-purpose systems that can perform diverse tasks in varied environments. China is positioning itself to lead this transition through three parallel advantages:

Manufacturing scale: The ability to produce and iterate robotic systems at unmatched volume and cost

Component control: Dominance in critical hardware supply chains

Government commitment: Sustained policy support and investment

General purpose robotics represents something fundamentally different from previous automation waves. These aren’t just tools that supplement human labor, but systems that can potentially replace humans entirely in the manufacturing process—operating 24/7 with higher throughput.

The Strategic Blindspot

Western companies and governments have fundamentally misunderstood what's happening. While American tech giants focus on software capabilities, China is systematically building the physical infrastructure to dominate the next manufacturing paradigm.

This isn't merely about economic competition—it's about who will control the means of production in the 21st century. As robotics systems begin manufacturing more robotics systems, costs will continue to fall while capabilities improve, creating a self-reinforcing cycle of advantage.

The Business Implications

For businesses around the world, the implications are profound:

Supply chain reconfiguration: Companies reliant on Chinese components face increasing strategic risk as China's manufacturers move up the value chain

Cost structure challenges: Western manufacturers will struggle to match Chinese pricing, forcing difficult choices between reshoring at higher costs or remaining dependent on Chinese suppliers

Innovation acceleration: The pace of robotics development will likely accelerate dramatically, making waiting on the sidelines an increasingly risky strategy

The Path Forward

For Western economies, competing directly on cost seems increasingly futile. Instead, the strategic response will likely require:

Focused investment in areas where Chinese manufacturers haven’t established dominance, particularly in advanced end-effectors and specialized applications

Policy coordination among allied nations to build resilient supply chains that aren’t wholly dependent on Chinese components

Software leadership that builds on existing advantages in AI and complex hardware integration

The robotics revolution isn't coming—it's already here, and China is leading it. The question isn't whether this will transform global manufacturing but who will control the transformation.

For businesses, governments, and investors outside China, the imperative is clear: recognize what's happening, understand its implications, and develop strategies that acknowledge the new industrial reality taking shape.

The countries and companies that prosper in this new landscape won't be those that resist the robotics revolution but those that find their place within it.