Breaking the Monopoly: How Google's Antitrust Battle Could Reshape AI's Future

As courts weight forced divestitures, the race for AI search dominance hangs in the balance

The current antitrust battles involving Google represent more than just legal challenges to an incumbent tech giant; they are fundamentally redrawing the competitive boundaries that will determine which AI companies thrive and which struggle in the coming years.

The Department of Justice isn't just looking to slap Google with a fine and call it a day. They're contemplating structural remedies that would fundamentally rewire how search data flows, how browsers distribute access to users, and how mobile operating systems can be leveraged for competitive advantage.

For companies like OpenAI, Perplexity, and Anthropic, the outcomes here could be as consequential as any technical breakthrough or funding round.

Think of it this way: you might have the most impressive AI model in the world, but if you can't get distribution, or if a competitor has a 100x data advantage that's legally protected, your technical excellence won't matter nearly as much as you'd hope.

That's why understanding these proceedings isn't just for legal teams or policy wonks—it's essential strategic intelligence for anyone making business decisions in the AI space today.

Illegal Monopolies in Search and Digital Advertising

At the heart of Google's antitrust troubles is its dominance in online search, where exclusive distribution agreements have been deemed anticompetitive.

Last August, a federal court found that Google protected its search monopoly through exclusive agreements with device manufacturers like Samsung to have its search engine installed as the default on new devices.

Beyond search, in a separate case, a federal court ruled in April 2025 that Google violated antitrust law by monopolizing open-web digital advertising markets.

The court found Google had a monopoly in two specific markets within advertising technology that web publishers use—the ad server and the ad exchange, though not in ad networks.

The government will likely push for Google to sell its ad server business, which independent publishers use to manage the sales of ads on their websites, and its ad exchange, which runs digital auctions between advertisers to serve ads every time someone loads a web page.

These rulings are particularly consequential because they open the door to structural remedies that could significantly alter the competitive landscape. As Reuters reported, Google "now faces the possibility of two U.S. courts ordering it to sell assets or change its business practices." This includes the possibility of divesting its Chrome browser and ending exclusive distribution deals that make Google search the default on many devices.

The Proposed Remedies: Breaking Up Google’s Ecosystem

The potential remedies fall into several broad categories that address different aspects of Google's monopolistic behavior:

Search distribution and revenue sharing: Eliminating exclusive distribution agreements that make Google the default search engine across devices and browsers.

Generation and display of search results: Changes to how Google prioritizes its own services in search results.

Advertising scale and monetization: Structural separation of Google's ad tech stack to prevent self-preferencing.

Accumulation and use of data: Limits on how Google can leverage user data across its various services.

These remedies aim to prevent Google from leveraging its dominance in one market to gain advantage in adjacent areas—particularly the rapidly emerging AI sector.

Perhaps most significantly, the Justice Department and a coalition of states have asked the court to force Google to share its search index and click-and-query data.

This would have profound implications for the competitive landscape, as this data is fundamental to training AI models for search and represents a competitive moat that new entrants currently cannot overcome.

Why AI is Part of the Antitrust Picture

These antitrust cases aren't merely about legacy search—they're increasingly about who will control the future of AI-powered information discovery.

Much of the trial has centered not on Google's traditional search engine but on the AI-powered search market, as the government has sought to convince the court that Google shouldn't be allowed to parlay its dominance in search into generative AI.

A big focus has been the power of Google's search data when it comes to AI products and AI models. This data advantage could potentially give Google an insurmountable lead in developing and improving AI systems, particularly for search.

The DOJ has explicitly argued that Google's search monopoly could extend into AI, with attorney David Dahlquist stating during trial that Google's

"search monopoly helps improve its AI products, which are also a way to lead users to its search engine."

This creates a self-reinforcing cycle where search dominance feeds AI development, which further entrenches search dominance.

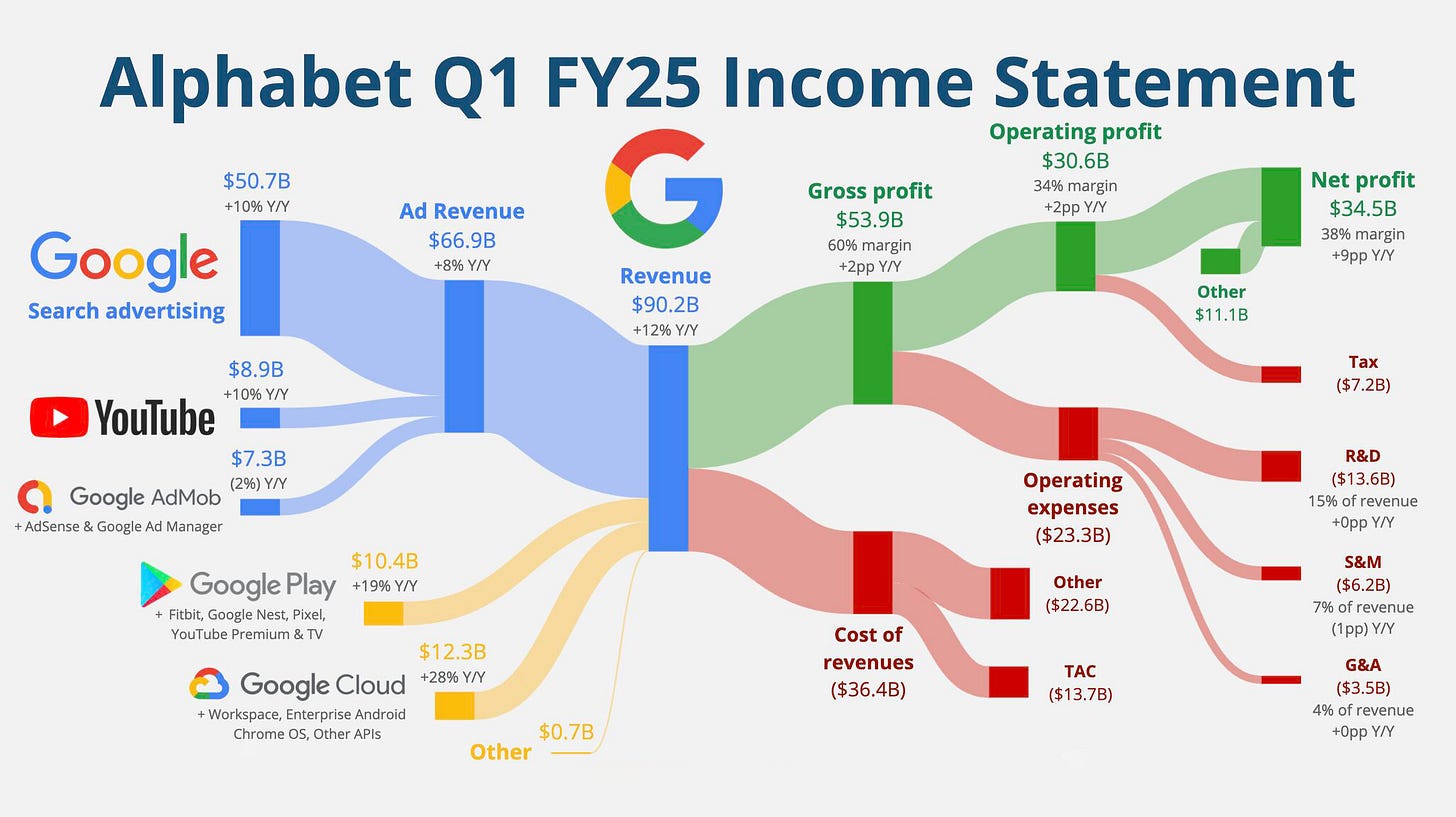

The DOJ's perspective is that Google's dominance in search will lead to dominance in generative AI, leveraging the power of Google's search data for AI products and AI models. Search data is used to train Gemini, Google's flagship AI model, and to build models for Google's AI Overviews Search product, creating a flywheel effect that competitors cannot match.

Search as the New Competitive Frontier

The competition around AI-powered search is already heating up despite Google's advantages.

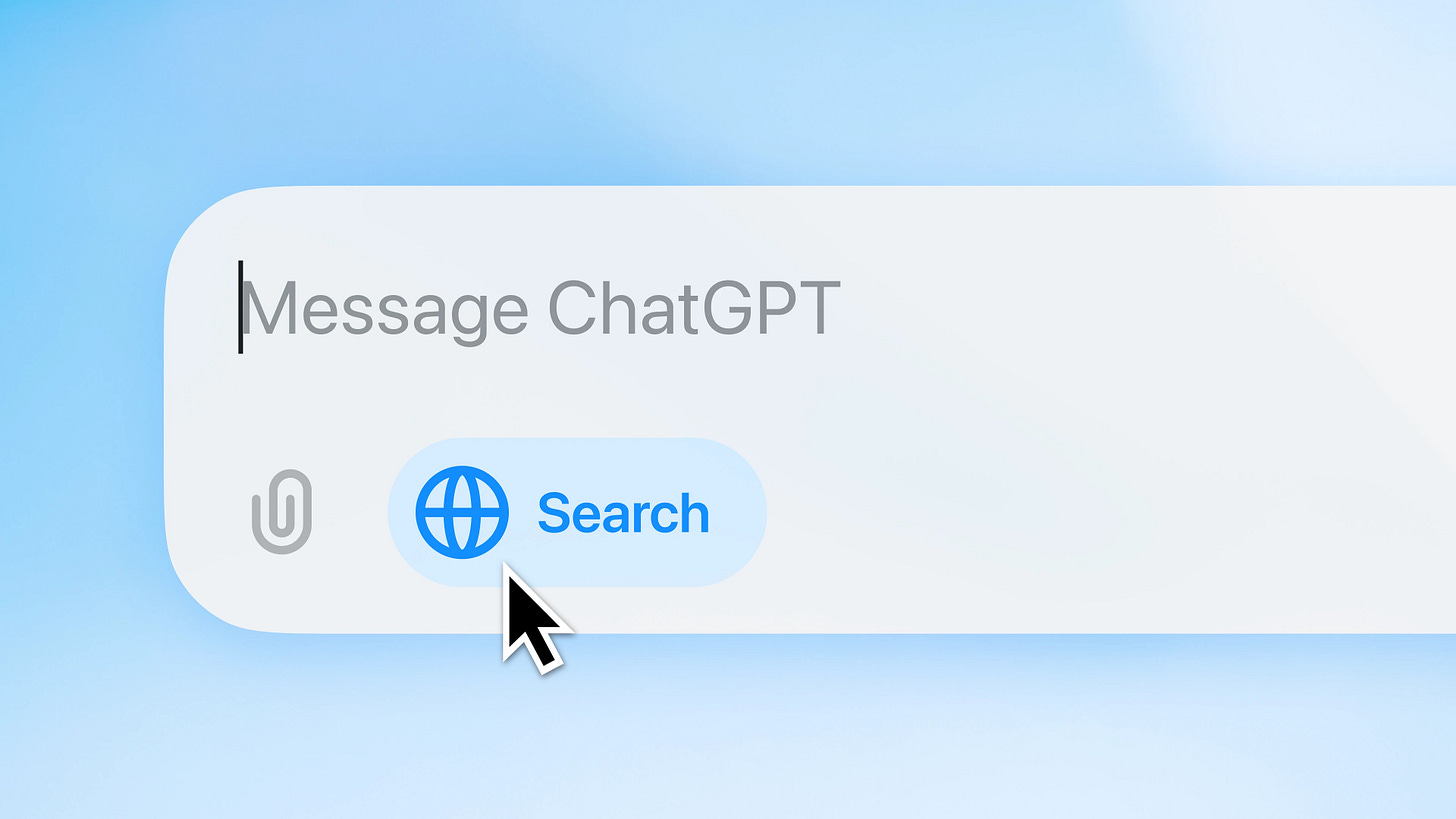

Perplexity is positioning itself to own the search space with a focus on being the "fastest and most accurate, and in the most efficient way" through search-grounded LLMs. Meanwhile, Grok, ChatGPT, and Anthropic are also competing in this area.

As Perplexity's CEO noted in a recent CNBC interview, "The market of providing answers to questions will become a commodity"—a stark shift from just a year ago when this capability was cutting-edge. The differentiating layer is moving toward multi-step chain research, workflows, actions, and capabilities like "Go and read all my reports and read the news on relevant stocks, look at my portfolio, now become a wealth manager and tell me how I should change it."

OpenAI estimates that it has 85% of the chatbot market, although Google searches with AI-generated answers still dwarf the number of SearchGPT searches. This suggests we're witnessing a bifurcation of the market—traditional search versus conversational AI—with significant overlap between them.

The competition is intensifying as OpenAI incorporates more shopping features into ChatGPT search results.

For web searches, ChatGPT now includes links to products with images and reviews. This opens up another avenue of competition with Google, whose browser-based shopping feature returns paid product listings above typical search results.

Chatbots, shopping assistants, and other AI tools are funneling more potential customers to online merchants, with traffic to U.S. commerce sites soaring 1,200% in February compared with July 2024, according to a recent Adobe report.

While AI search remains small compared to traditional search, with only 39% of consumers having used an AI search engine, the rapid growth points to a potential shift in shopper behavior that could upend how e-commerce sites attract customers and impact the roughly $800 billion a year retailers spend on digital ads.

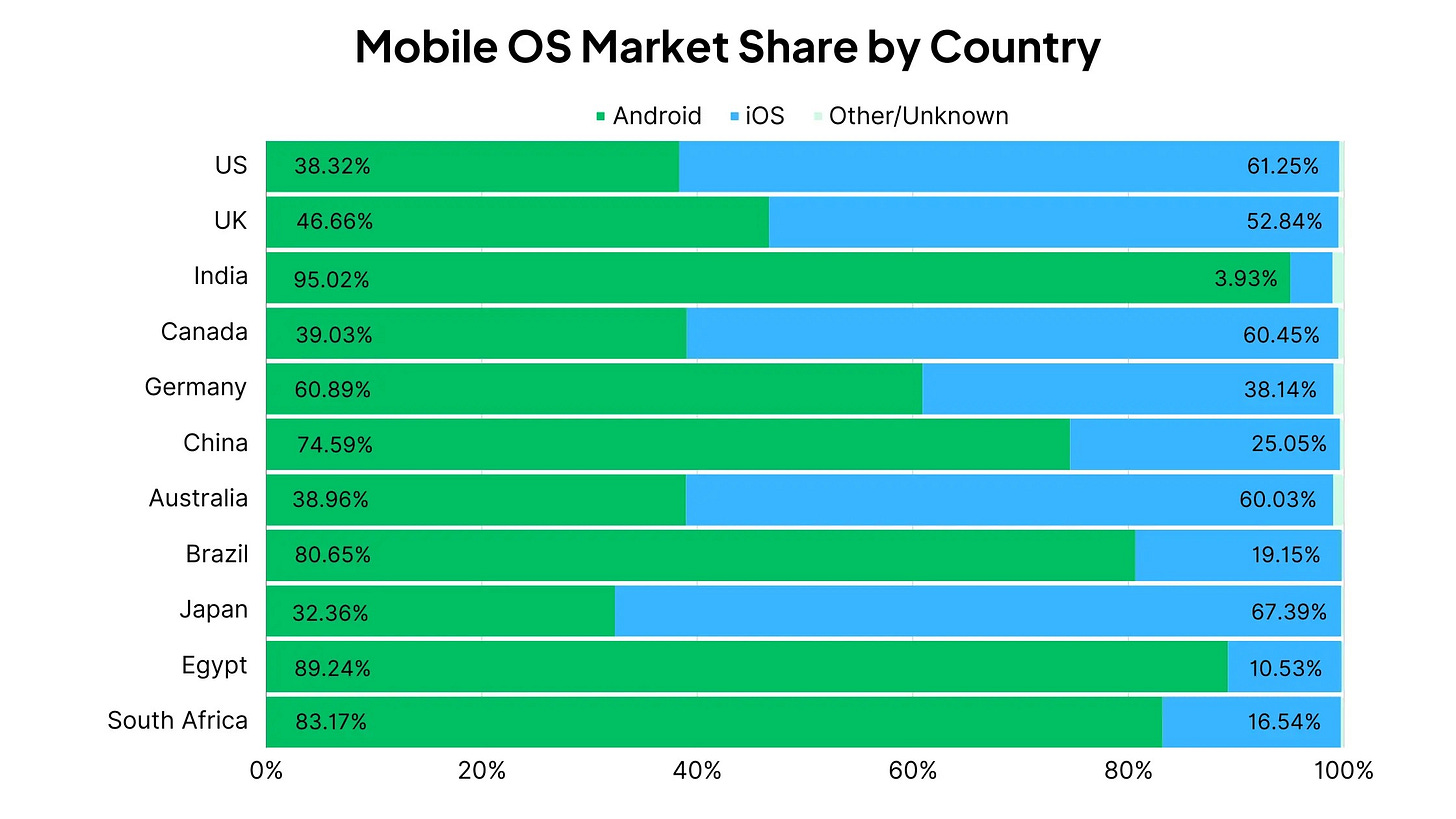

The Mobile Ecosystem’s Critical Role

Google's stance with Android has been criticized as hypocritical. While claiming Android is open source, Google dictates terms with Original Equipment Manufacturers (OEMs) to promote Google apps and doesn't allow competitors like Perplexity as the default search app even if manufacturers want it.

There are different tiers of distribution agreements that OEMs can have, but Google only offers Google Play/Google Search revenue sharing on certain tiers. This creates powerful economic incentives for manufacturers to maintain Google's preferred app configuration.

Google's Play Store is a critical component of this strategy. As internal documents revealed in the antitrust trial, an Android phone without the Play Store is a "brick"; everyone else has carrots to win deals, but the Play Store gives Google a "big stick." It is not commercially feasible for an OEM to ship Android devices without Google Play Store preinstalled.

Meanwhile, competitors are seeking new distribution channels. Perplexity AI is in discussions with Samsung Electronics about integrating its assistant on the smartphone giant's devices and has already reached an agreement with Lenovo Group's Motorola for a similar arrangement.

The terms could involve offering Perplexity as a default AI assistant option or preloading the startup's Android app on phones. Samsung, the worldwide smartphone market leader, also could promote the assistant heavily as an option within the Galaxy Store.

The Strategic Importance of Browsers: A “Chrome-plated” Question

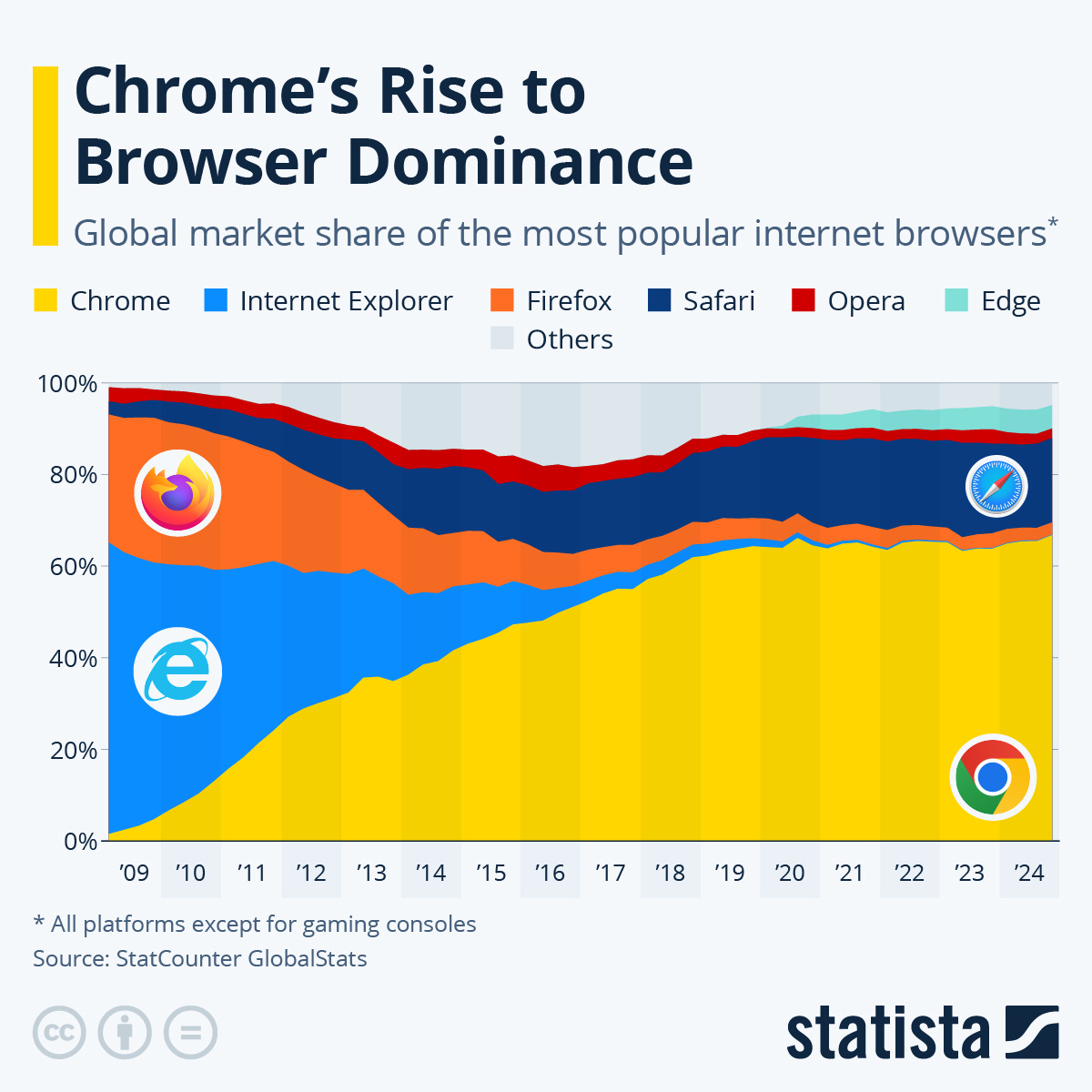

Perhaps the most dramatic potential remedy is the forced divestiture of Chrome. Browsers represent critical infrastructure for AI companies seeking to distribute their products.

As OpenAI’s Nick Turley, ChatGPT Head of Product, testified during the remedies hearing, a distribution agreement with Chrome—making ChatGPT a preset search option—would allow "more people to discover our product." Furthermore, when asked if OpenAI would be interested in acquiring Chrome if it were divested, he stated that they would.

While Chrome doesn't itself generate direct revenue, it is a key conduit to guide people to Google's tools like search and Google Maps, which are revenue-generators. This is precisely why divesting Chrome could meaningfully impact Google's foothold on search.

The rationale is clear: Chrome is essential to Google's search dominance.

Concerns about the availability of Chromium, the open-source browser project from which Chrome is derived, have also been raised in regards to a purchase of Chrome by any company (particularly “ClosedAI”).

Chromium serves as the foundation not just for Chrome but also for Microsoft Edge, Samsung Internet, Opera, and other browsers. If controlled by a company perceived as less committed to open source principles, the competitive dynamics of the browser market could be further compromised.

For emerging AI-focused browsers like Perplexity's Comet, which is also built on Chromium, the future governance of this project holds significant implications. Any remedy affecting Chrome must carefully consider impacts on the broader Chromium ecosystem to avoid unintended consequences for competition.

Broader Industry Implications

As we look toward the future of competition in search and advertising markets, three key insights emerge from the ongoing antitrust cases against Google.

Data access will continue to be critical to competitive dynamics. Whether through mandated data sharing or other mechanisms, ensuring multiple companies have access to sufficient training data will be essential for preventing the same monopolistic patterns from emerging in AI that have characterized search.

Distribution will continue to be a competitive battleground. The DOJ's focus on Google's distribution agreements recognizes that even superior technology struggles to gain adoption without effective distribution channels. Future competition policy may need to address similar bottlenecks in AI distribution.

Commoditization of basic AI capabilities will accelerate dramatically. At this point in time, most of the commercially available LLMs are able to answer the large majority of questions equally well. Differentiation over the next iterations of LLM-based search will, at a minimum, require specialized capabilities and multi-step workflow integration.

For companies building in the AI space, these antitrust proceedings are not merely legal curiosities—they may fundamentally determine who gets to compete in the next generation of information retrieval and processing. The outcomes will influence not just the economics of search and advertising, but potentially the architecture of the Internet itself.

Furthermore, the cases raise profound questions about the nature of competition in the digital age:

How should we balance the benefits of integration against the need for competition?

How can we ensure that the data advantages accumulated by dominant platforms don't permanently foreclose competition in adjacent markets?

How should antitrust law evolve to address the unique characteristics of multi-sided platforms and data-driven business models?

As we stand at this crossroads, it's clear that the decisions made in these cases will reverberate far beyond Google, potentially reshaping the competitive dynamics of the entire technology sector and establishing the rules of the road for AI competition for decades to come. For users, they'll ultimately influence the quality, diversity, cost, and privacy implications of the AI services we increasingly rely upon in our daily lives.